|

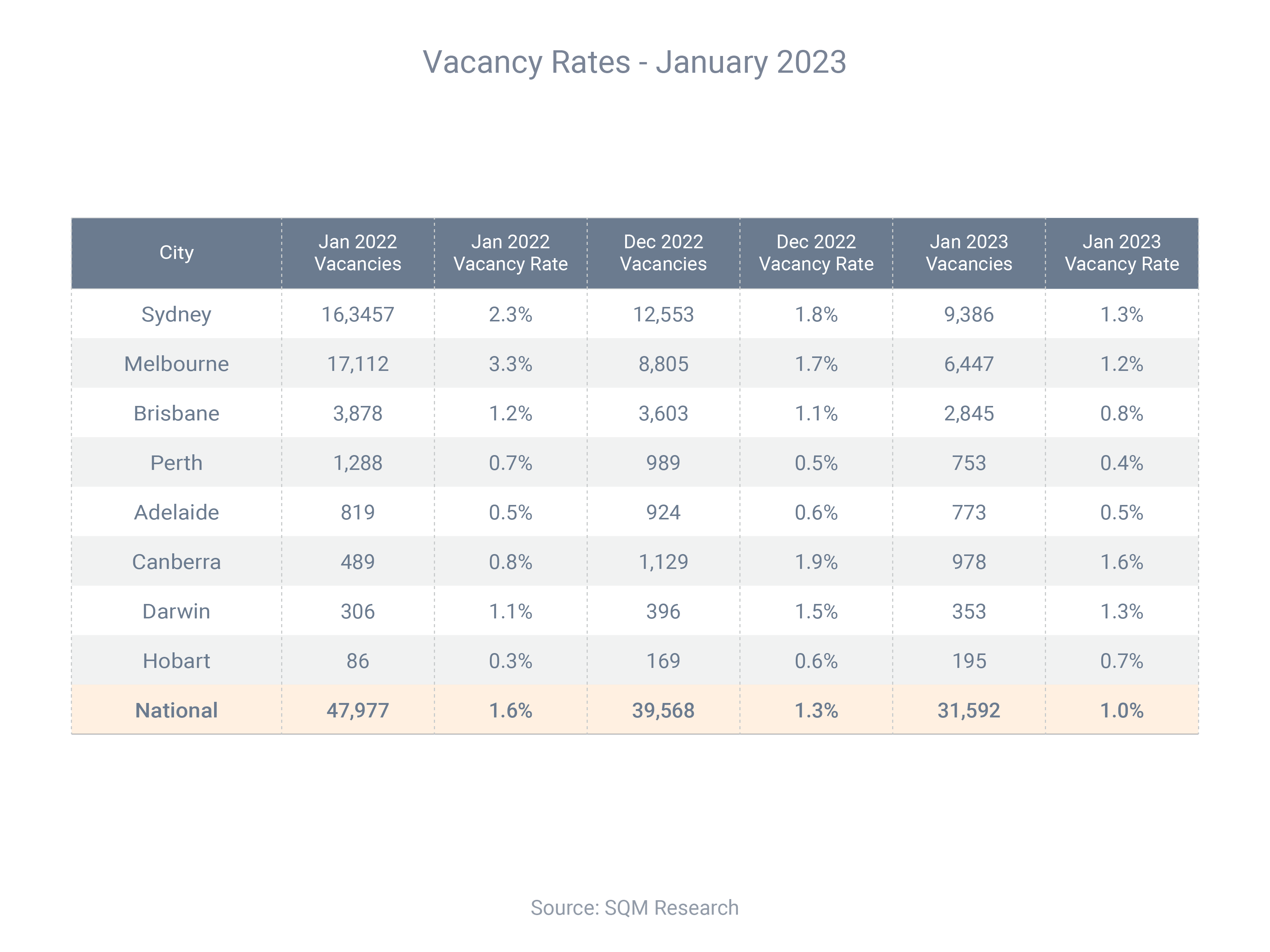

| The rental market has turned decisively in favour of property investors, with the number of vacant rental properties plummeting by one-third over a 12-month period. Between January of 2022 and 2023, the number of rental vacancies across Australia fell from 47,977 to 31,592, a reduction of 34.2%, according to SQM Research. |

|

| At the same time, the vacancy rate – which measures the share of untenanted rental properties – fell from an already-low 1.6% to just 1.0%. Vacancy rates differ from city to city, but are low throughout the country, ranging from 0.4% in Perth to 1.6% in Canberra. SQM Research managing director Louis Christopher said low vacancy rates were contributing to a “surge in rents”, which in turn was pushing up rental yields. “I believe would-be investors will be attracted to higher rental yields in later 2023, provided the cash rate peaks at below 4% [it’s currently 3.35%],” he said. Get in touch if you need an investment loan |

|

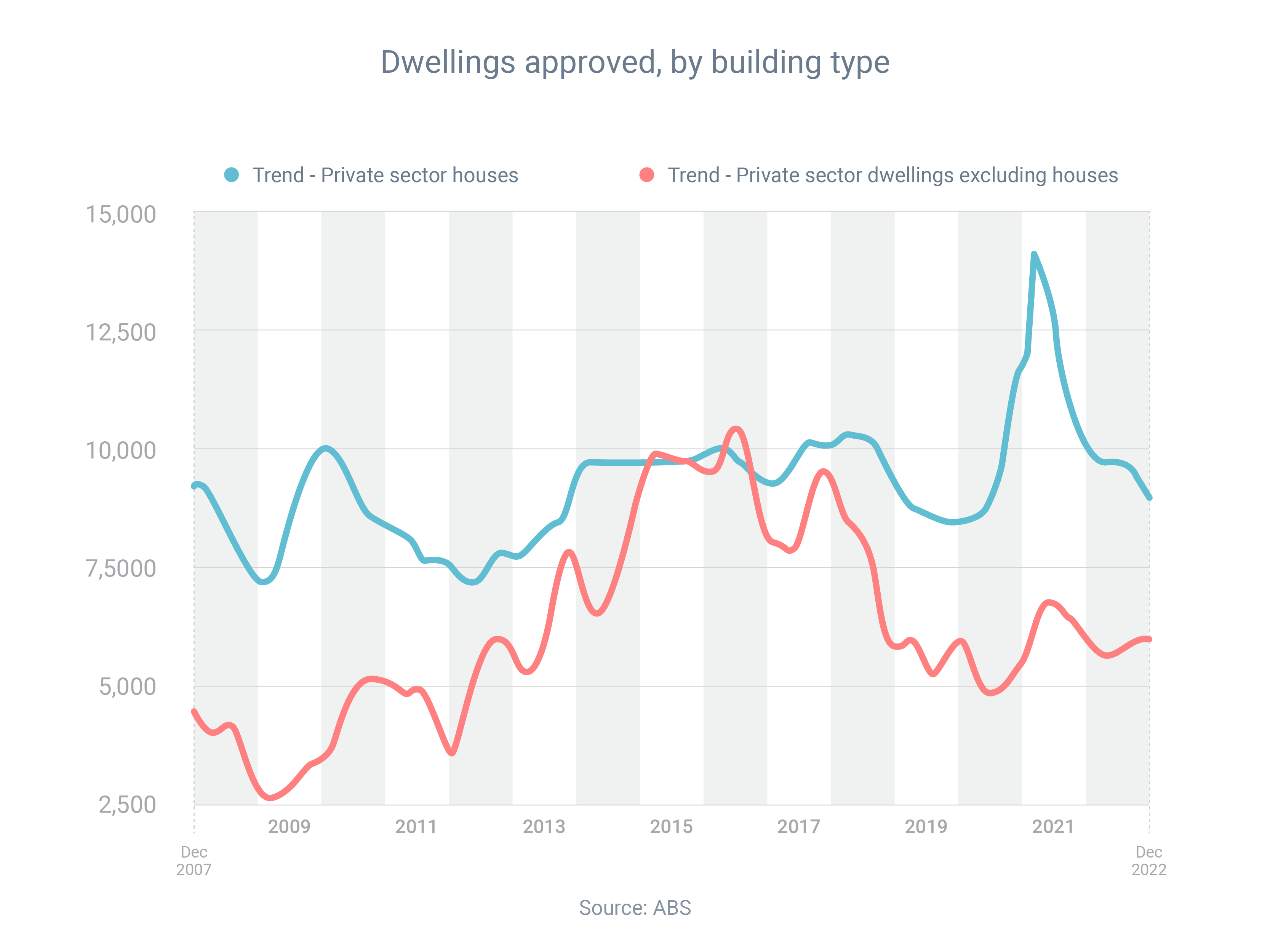

| There was a steady decline in the amount of new residential construction that was approved during 2022, according to the latest data from the Australian Bureau of Statistics. A total of 188,765 home building approvals were issued in 2022, compared to 226,629 the year before – a reduction of 16.7%. |

|

| Although approval numbers jumped around throughout 2022 – higher in some months, lower in others – the clear trend was down. “Much of the decline between 2021 and 2022 was the expected consequence of the end of the HomeBuilder grant in 2021,” Housing Industry Association chief economist Tim Reardon said. “The market was also cooling as the cost of construction rose, and the change in consumer preferences due to the pandemic desire for space, eroded.” Mr Reardon said builders are still working through a “significant pipeline of work”, and that the slowdown in building approval numbers “will not hit building activity on the ground until late 2023”. Need a construction loan? Let’s talk |

|

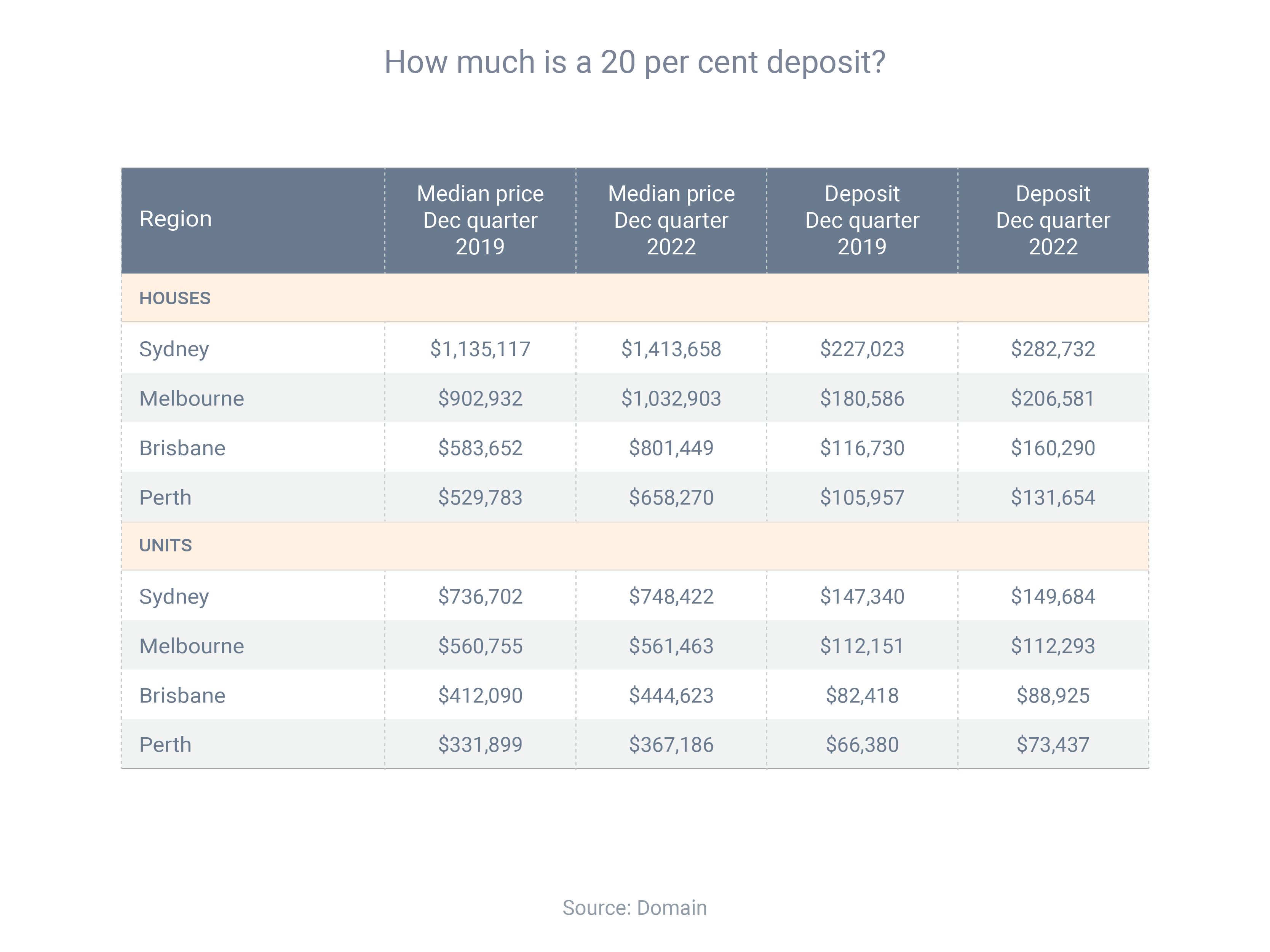

| Despite the recent housing downturn, property prices are higher in most parts of the country than before the pandemic. As a result, deposit requirements are higher. Domain compared property prices in the December quarters of 2019 and 2022, and found that buyers needed tens of thousands of dollars more today if they wanted to buy a house and put down a 20% deposit. The increase in 20% house deposits for our four biggest cities was: Sydney $55,709 increase between 2019 and 2022Melbourne $25,995Brisbane $43,560Perth $25,697 |

|

| While the deposit barrier is high, it’s not insurmountable. As an expert mortgage broker, I can potentially help you enter the market with a low-deposit loan. Generally, if your deposit is lower than 20%, you will need to pay lender’s mortgage insurance (which can be added to your loan). While it’s never nice to pay an added fee, it can be money well spent if it lets you buy a property several years ahead of schedule. Get strategic mortgage help |

|

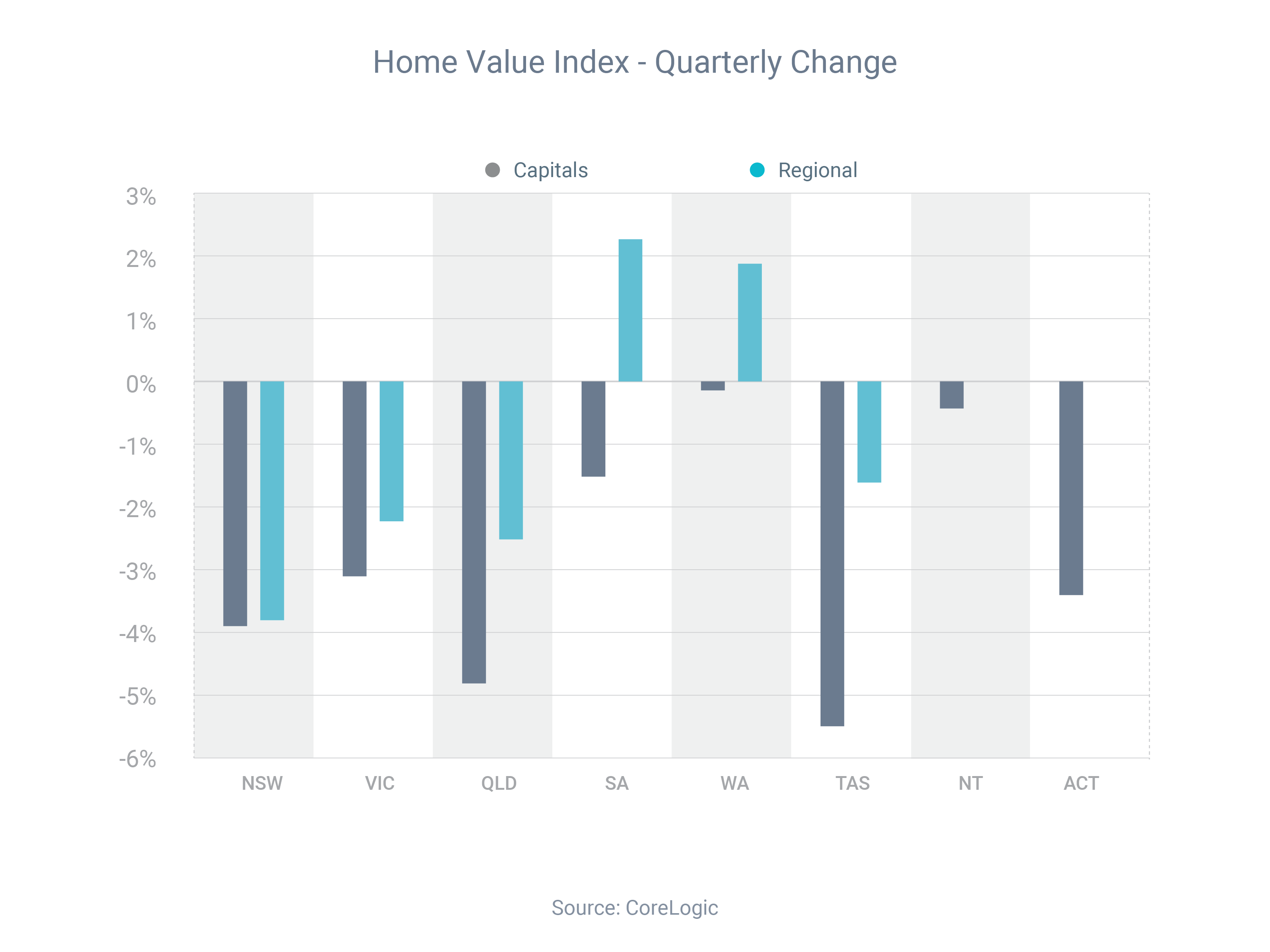

| Evidence is emerging that the national housing market downturn, which began in May 2022, is slowing. CoreLogic has reported that the nation’s median property price fell 1.0% in January – the smallest month-on-month decline since June 2022. Meanwhile, while the national median price fell 4.1% in the October quarter, it fell only 3.2% in the January quarter. |

|

| Here’s how much prices fell in each capital city in both the three months to January and the three months to October: Perth -0.1% (was -0.7% in October quarter)Darwin -0.4% (was 0.0%)Adelaide -1.5% (was -0.6%)Melbourne -3.1% (was -3.1%)Canberra -3.4% (was -4.3%)Sydney -3.9% (was -5.3%)Brisbane -4.8% (was -5.4%)Hobart -5.5% (was -4.1%) In other words, while prices are still decreasing, they’re doing so at a decreasing rate. Reach out if you want to buy a property |

Thanks for reading. All the best to you and your family. As always, get in touch if I can help in any way. Book a Free Appointment Kind Regards, Justin Doobov 02 9300 6699 Thanks for reading. All the best to you and your family. As always, get in touch if I can help in any way. Book a Free Appointment Kind Regards, Justin Doobov 02 9300 6699 |