In this article, CoreLogic Economist Kaytlin Ezzy explores Australia’s unit market and the looming shortfall in median-high density housing stock.

The medium to high-density sector has increasingly become an important part of Australia’s residential real estate market, with units steadily making up a larger portion of Australia’s housing stock. In August, CoreLogic estimated that units made up 25.9% of national housing stock and around 30.4% of Australia’s capital city housing stock, up from 19.6% and 22.9% at the start of 2010, respectively.

The continued reliance on the unit sector to deliver fresh housing stock is particularly evident across some of Australia’s largest capitals, including Sydney and Melbourne, as well as the ACT, where limited land supply has made further development of low-density dwellings increasingly difficult.

The medium to high-density sector is increasingly becoming an important tool in delivering additional housing stock for Australia’s growing population, especially as households continue to congregate in metropolitan areas.

With a median value of $637,593 (around 30% cheaper than capital city houses), capital city units offer a significantly more affordable entry point for first home buyers, as well as a lower maintenance option for both investors and downsizers.

However, the latest National Housing Finance and Investment Corporation (NHFIC) ‘State of the Nation’s Housing’ report forecasts a national housing deficit of approximately 106,300 by 2027 (later upgraded to 175,000), with around 59% of the shortfall expected in the unit market.

Below-average unit approvals and completions

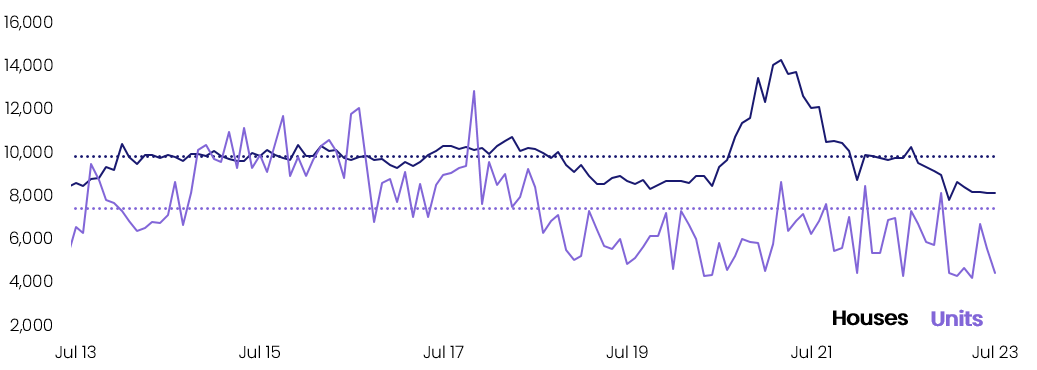

Figure 1 shows the latest ABS building approvals data by property type. In July, 4,490 units were approved for construction, down -19.9% from the month prior and -39.8% below the decade average. Excluding a handful of volatile months, the trend in new unit approvals has largely held below the decade average since mid-2018 and well below the trend in house approvals since late 2017.

Figure 1 – National monthly housing approval by property type

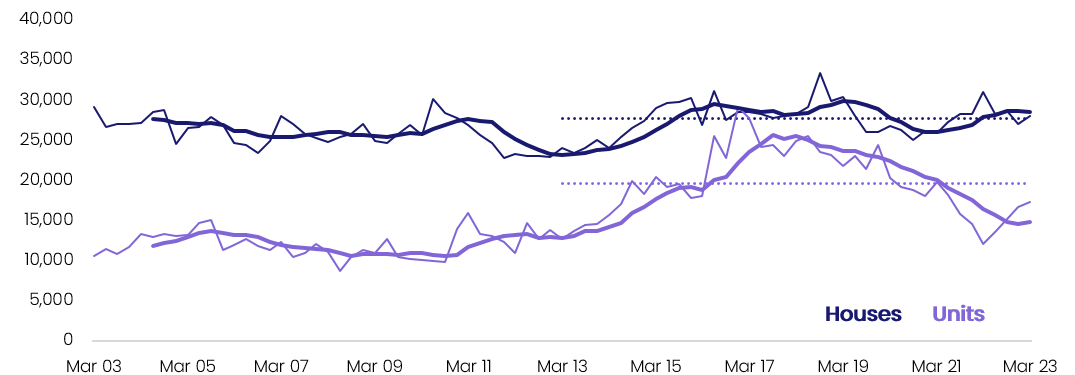

Unsurprisingly, the latest ABS building activity data, displayed in Figure 2, also shows an easing in unit completions, while house completions have held close to the decade average.

In the past 10 years, units have accounted for approximately 41.7% of total new housing completions nationally. However, over the March quarter of 2023, units made up just 37.1% of completions, holding around -27.1% below the decade average.

Figure 2 – National quarterly housing completion – by property type

Despite surging demand, developers and consumers alike are exercising a more cautious approach in light of uncertain economic conditions, weaker capital gains, high construction costs, a tight labour market for trades and rising interest rates. With fewer unit projects set to move through the construction pipeline, it’s likely completions will continue to ease, with units making up a smaller portion of new housing stock over the coming years.

It is worth noting that while completions and approvals are low, the pipeline of unit projects yet to be completed is relatively high. Unit commencements have shot up from 12,782 in the December quarter of last year to 19,981 through the first quarter of 2023. Constraints across the building sector have meant the number of units approved but yet to be completed have swelled to over 158,000 as of March this year. However, both unit commencements and the total number of approved units in the pipeline yet to be completed, remain below the highs of the mid-2010s. While unit construction fails to reach new highs, demand pressures for housing remain high.

Increased demand from imbalance between overseas arrivals and departures

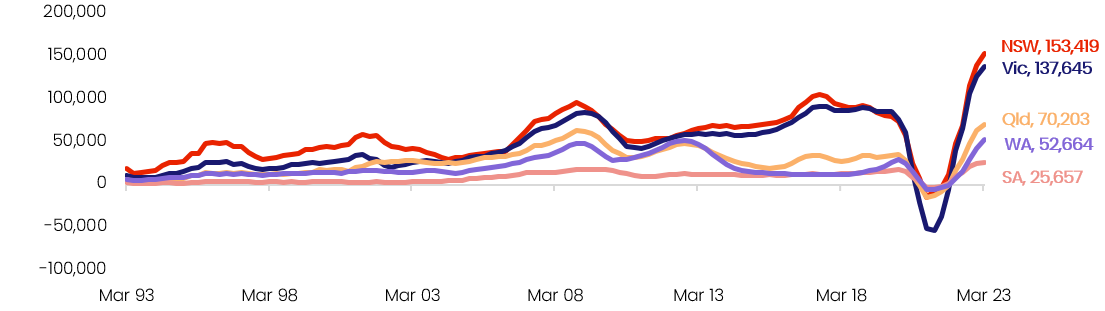

On the demand side, a stronger-than-expected level of net overseas migration has seen overall housing demand skyrocket. This has occurred amid high levels of overseas arrivals, and about a 25% drop off in departures relative to the pre-COVID average. Figure 3 displays the annual trend in net overseas migration by state. In the year to March 2023, net overseas migration reached a new record high, with 454,400 people added to Australia’s population. At the current average household size, this equates to an additional 181,723 households.

Historically, ABS migration data shows high-density markets in major cities have had higher exposure to uplifts in net overseas migration. Looking at historic averages from 2016 onwards, the SA4 regions of Melbourne’s South East, Melbourne Inner, Sydney’s Inner South West, and Parramatta saw the highest net overseas migration levels. The majority of recent long-term migrant arrivals rent before buying. The impact of this additional demand has already been seen in the rental market, with capital city unit rents recording a new record high annual growth rate over the year to May (16.5%) before easing slightly over the 12 months to August (14.9%).

While worsening rental affordability has seen the pace of unit rental growth ease in recent months, unit rents are likely to remain elevated for some time, especially with net overseas migration expected to remain high through 2023 and 2024.

Figure 3 – Annual count of net-overseas migration

The impact of a short fall on unit values

Units have historically been a relatively affordable entry point for owner-occupier buyers looking for a first home, or investors looking for decent rent yields. In a low and declining interest rate environment, the apartment boom of the 2010s contributed to persistently low growth in annual rents across the country (averaging about 2% per year), and through the recent pandemic upswing, detached house values ballooned relative the unit sector.

However, in the face of rising demand and record low interest rates, the early 2020’s have not been marked by the same uplift in unit construction. At the moment, an elevated pipeline of units under construction, high interest rates and low consumer sentiment could temper unit demand and price growth. But once the pipeline is worked through, Australia faces a relatively low number of approved projects, which may create a temporary vacuum in new unit supply. With the cash rate potentially easing in 2024, greater purchasing demand could fuel a stronger